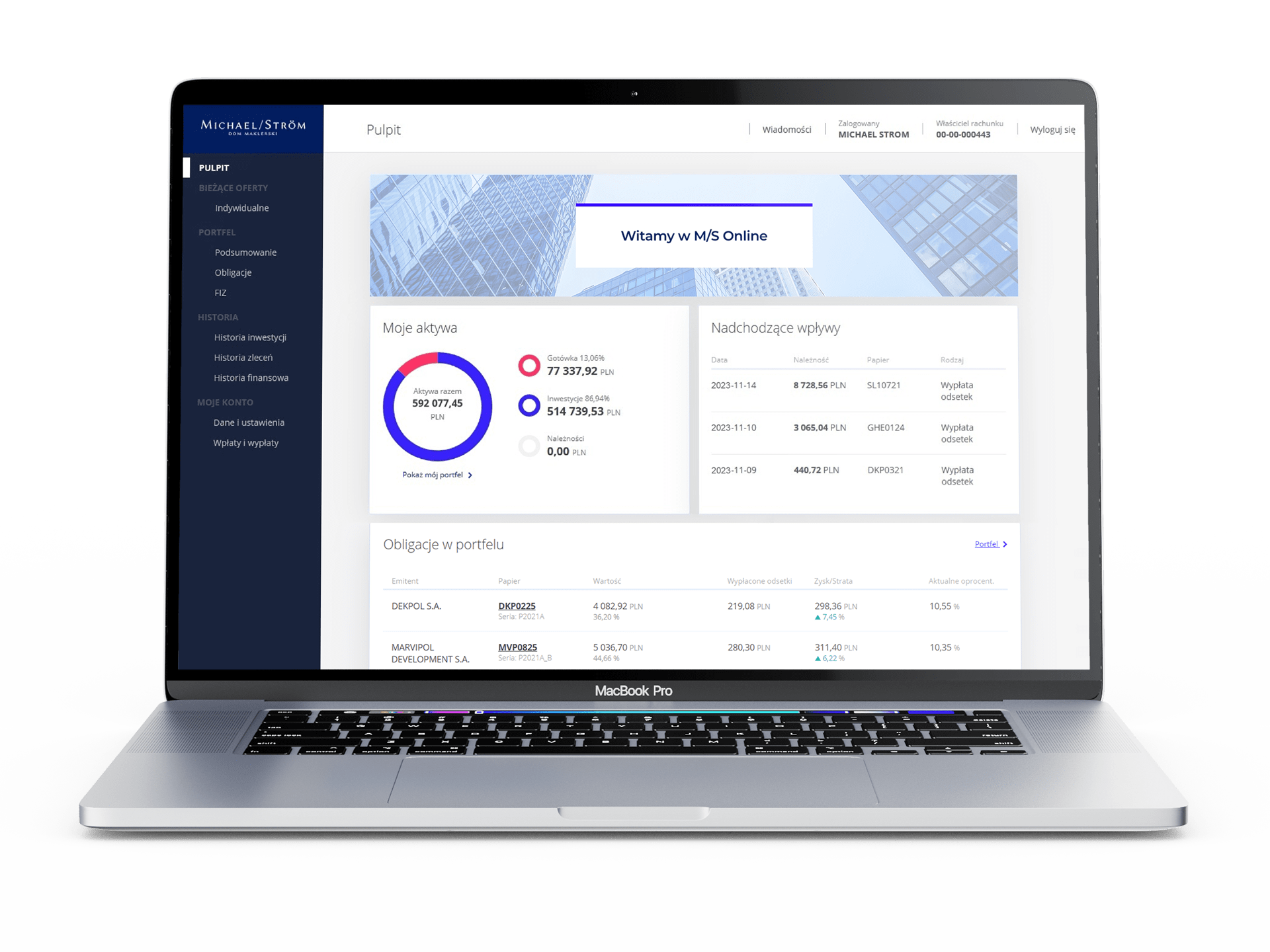

Why invest with us?

5 model strategies as part of our Asset Management

Over 2700 individual Clients

PLN 4,5 bn

financing raised for our Clients

Average interest rate on bonds****

Indeks Default Rate*

1st place as regards the number of Issuers**

2nd place as regards the number of issues carried out***

experienced team

* Issues past maturity that have not been repaid. Amount for the period 1 January 2015 - 30 June 2022.

** According to the Cbonds.pl ranking, 2021

*** According to the Cbonds.pl ranking, 2021

What you can invest in

Invest and profit

Corporate bonds

average interest rate 6.58%*

primary and secondary market

diversified investment horizon

regular interest payments

Invest and profit

Treasury bonds

issued or guaranteed by the State Treasury

maximum security

possible quick exit from investment

automatic redemption at the end of the investment period

Invest in funds

Open-End Funds

15 Investment Fund Comanies in one place

over 970 Open-End Funds and Specialised Open-End Funds available

5 model strategies tailored to selected risk levels

9 locations and more than 40 advisers who will be happy to present the financial products on offer

Invest in funds

Closed-End Funds

selected closed-end fund range

possibility of diversifying your portfolio

Invest consciously

set your goal

estimate your budget

match the right product

diversify your risk

stay in touch with your Adviser

Michael / Ström

in numbers

Everyone is special. Our passions, needs and plans set us apart. What we have in common, however, is the search for harmony in the financial world. Michael / Ström Dom Maklerski provides a range of clear and simple solutions to help you build your investment portfolio so that it works effectively. Our experience and professed values form also an efficient tool for anyone expecting efficiency and professional support in corporate finance and investment banking transactions.

18 mld zł

ponad 18 mld zł rocznego obrotu na rynku wtórnym papierów dłużnych

8,8 mld zł

8,8 mld zł w zrealizowanych transakcjach na rynku pierwotnym

4,1 mld zł

ponad 4,1 mld zł zdeponowanych aktywów

407

407 przeprowadzonych emisji obligacji

8,3 mld zł

ponad 8,3 mld zł zainwestowanych środków przez Inwestorów indywidualnych

83

83 Emitentów

5 200

ponad 5 200 prowadzonych rachunków maklerskich

Presentation about the company

download