Corporate bonds

Michael / Ström Dom Maklerski S.A. analyses potential bond issuers, selects them and comprehensively prepares the bond issue process. In accordance with our philosophy, the bonds on offer are characterised by a moderate risk level. Bonds may be offered to investors in various ways, either through personalised purchase proposals or offers to unspecified addressees.

6,58

%

*

average interest rate on bonds

*Average interest rate for all bond series offered for purchase to retail Clients by M/S DM S.A.- calculated on an annual basis for the weighted average of bond offerings carried out in the period from 1 January 2015 to 30 June 2022 based on the initial interest rate. The figures refer to the past and are not an indicator for the future to be relied on.

What is a corporate bond?

A bond is a security issued in a series (divided into a certain number of equal units) where the issuer states that it is a debtor to the bond owner, called the bondholder, and undertakes to the bondholder to provide a specific performance. Corporate bonds are issued by companies. The usual scope of performance is an obligation to return the bond’s face value at a specified maturity - e.g. after 3 years - and an obligation to pay interest (coupons) on a cyclical basis, e.g. every three months.

Usually the issue price of 1 bond is equal to its face value - the redemption value, e.g. PLN 100 or PLN 1,000.

In most cases, companies issue bonds to raise funds to finance growth investments or ongoing operations.

Who Can Purchase corporate bonds?

Corporate bonds can be purchased by individual or institutional investors who expect a higher yield than on bank deposits or treasury bonds and do not want to bear the relatively high risk characteristic of equities.

50

Issuers

235

corporate bond issues executed

6,58%*

average interest rate on bonds

PLN 4,5 bn

PLN 4,5 bn financing raised

3 years

the maturity date is usually 3 years

2,35%**

Default Rate

* Average interest rate for all bond series offered for purchase to retail Clients by M/S DM S.A.- calculated on an annual basis for the weighted average of bond offerings carried out in the period from 1 January 2015 to 30 June 2022 based on the initial interest rate. The figures refer to the past and are not an indicator for the future to be relied on.

** Issues past maturity that have not been repaid in relation to all issues. Amount for the period 1 January 2015 - 30 June 2022.

We are trusted by

Advantages of Investing in Corporate Bonds

interest rate higher compared to bonds issued by the State Treasury

bonds can be sold before maturity

security measures possible

Corporate bonds on our offer

We offer bonds of recognised companies with good financial standing

6,58% average interest rate on the bonds*

Bonds are usually issued in denominations of PLN 100 or PLN 1,000

*Average interest rate for all bond series offered for purchase to retail Clients by M/S DM S.A.- calculated on an annual basis for the weighted average of bond offerings carried out in the period from 1 January 2015 to 30 June 2022 based on the initial interest rate. The figures refer to the past and are not an indicator for the future to be relied on.

What are the risks?

Investing in bonds involves the following risks:

risk of the issuer’s insolvency or bankruptcy resulting in the loss of all or part of the funds invested by the bondholder

risk related to the macroeconomic and economic situation

risk of delay in making interest payments or redemption

operational risk

risk of mismanagement

financial risk

market price and liquidity risks

risk of trading suspension or exclusion of a financial instrument from trading

interest rate risk

reinvestment risk

early redemption risk

How to purchase corporate bonds?

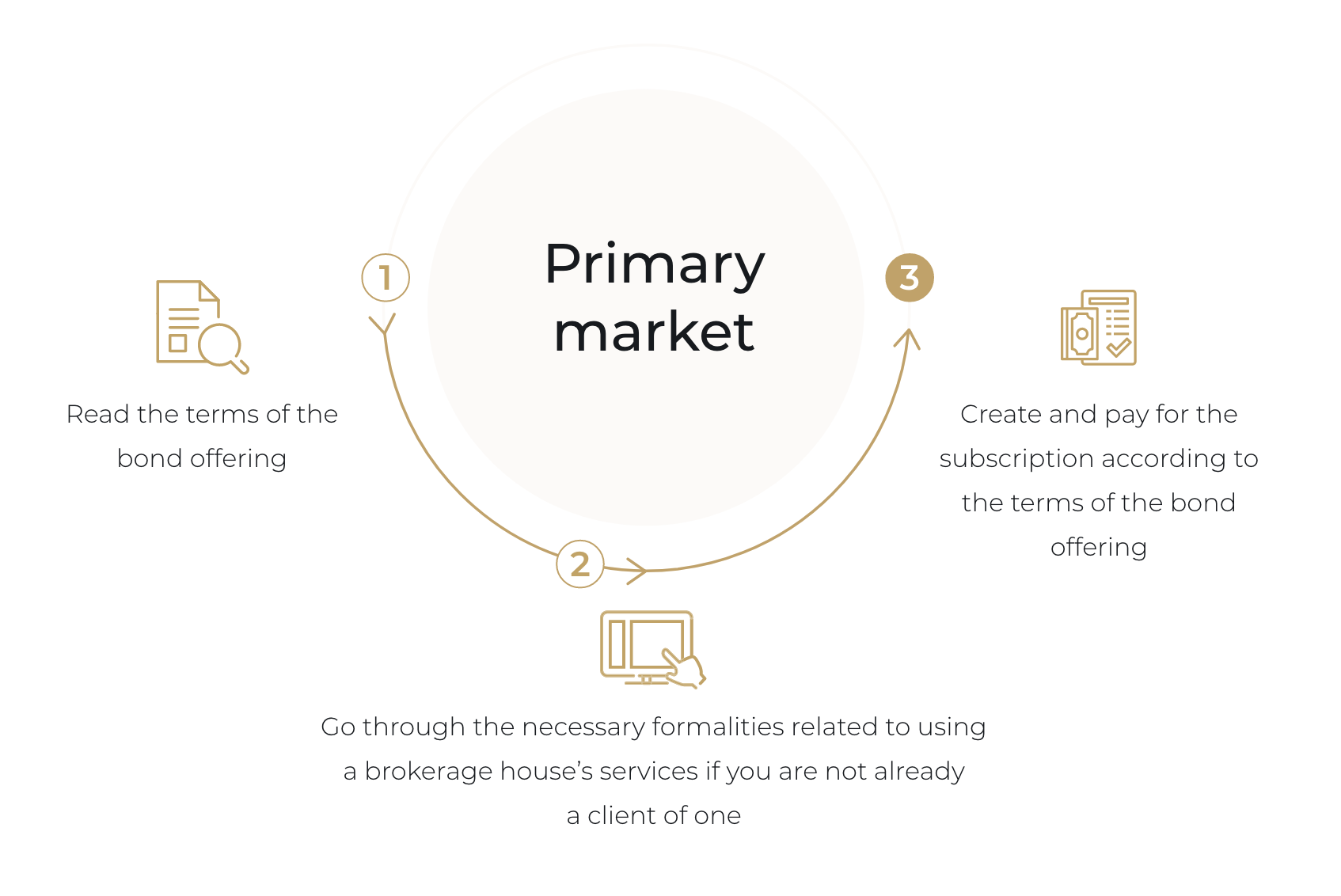

Primary market

Investors subscribe for bonds, and then funds representing the bond price are transferred to the bond issuer. In the primary market, bonds may be offered by way of purchase proposals to named addressees or by way of publicly available information, aimed at unspecified addressees, about the bond offering and the terms and conditions of the purchase. Subscription, issue approval and other formalities usually take up to 3 weeks.

Secondary market

Secondary market bonds can be purchased for instance in the Catalyst bond market or as part of so-called over-the-counter (OTC) transactions. The funds representing the bond price are transferred to the investor selling the bonds. The securities are credited to your brokerage account immediately after the transaction.

The material is for information purposes, constitutes a trade publication and is published to advertise the brokerage services provided by Michael / Ström Dom Maklerski S.A. Corporate bonds are not bank deposits and are not covered by any deposit guarantee scheme. Investing in corporate bonds involves investment risk and may result in losses.