The service is provided under a contract between the Client and Michael / Ström and based on a power of attorney granted by the Client.

Successful investing is a very important skill for increasing budgets. Adequate knowledge of how to analyse financial statements or assess the prospects of particular industries, asset classes or market segments, backed up by our Team’s many years of practical experience, may prove to be the key to achieve your investment objectives.

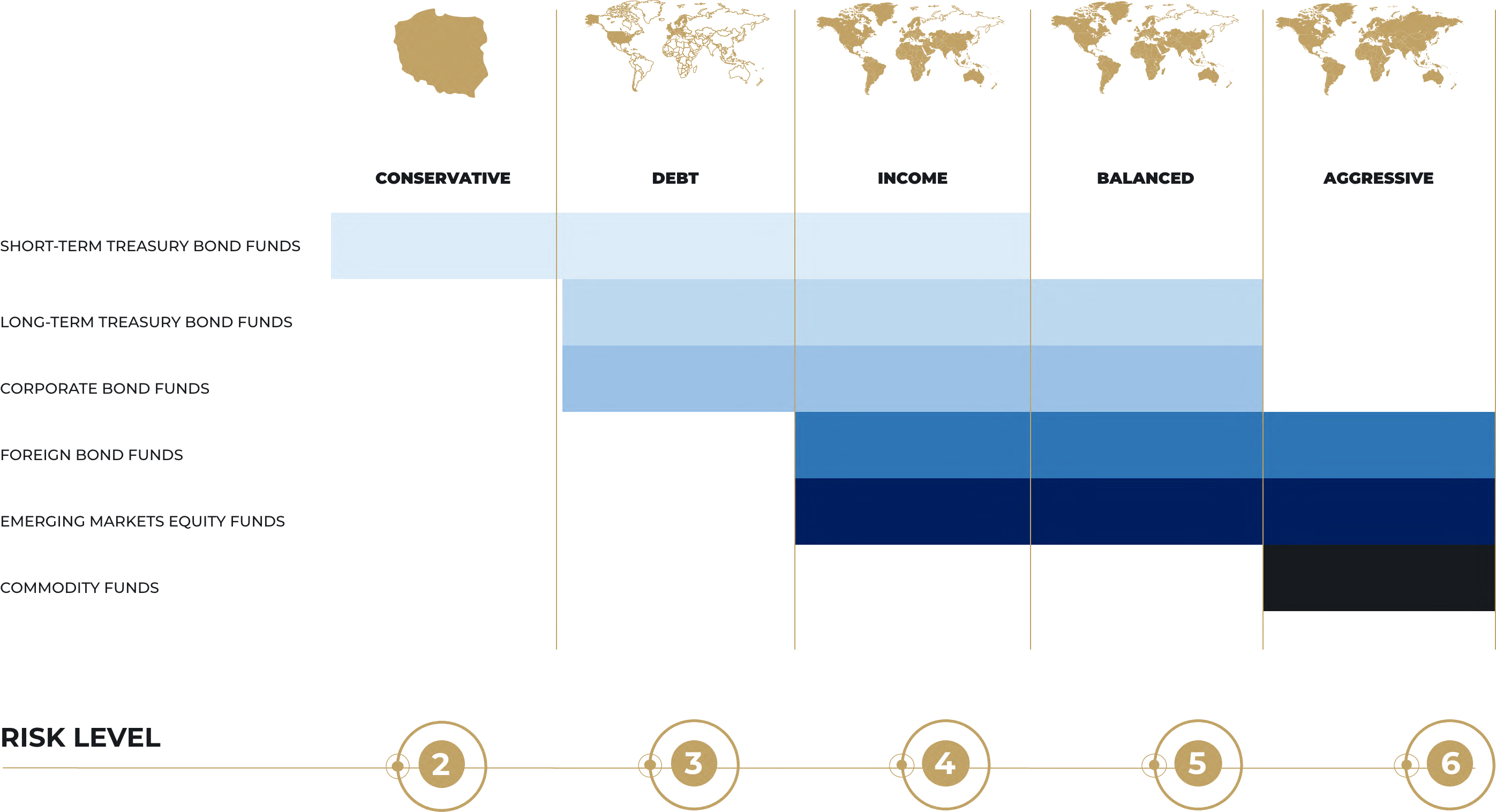

In building our Clients’ investment portfolios, we use both model strategies specially designed by our Asset Management Team as well as strategies arranged individually.

Appropriately adjusted and differentiated levels of accepted risk, expected rate of return and investment horizon ensure a broad spectrum of opportunities even for demanding investors.

If you are looking for someone to actively manage your surplus funds, whether private or your company’s, feel free to contact us. We will be happy to answer all your questions.